MBK Partners acquired Homeplus in late 2015 for about 7 trillion won, with 5 trillion won financed through loans under Homeplus’ name. However, after gaining control, Homeplus’ performance declined each year. The recent corporate rehabilitation filing has severely impacted securities firms, investors and partner companies with stakes in the retailer.

Industry analysts criticize MBK for failing to execute management strategies that could have enhanced Homeplus value. Instead of focusing on business growth, the firm prioritized repaying acquisition-related debt and pursued an irrational strategy of selling off profitable stores. As a result, Homeplus fell behind online retailers and competitors, leading to worsening financial conditions. MBK’s private equity strategy enhancing corporate value for a profitable exit ultimately failed in this case.

|

Bain Capital’s Success With Hugel, Market Leader in Botulinum Toxin

Unlike MBK, Bain Capital has taken a different approach, focusing on biotech investments such as Hugel and Classys.

Bain Capital acquired Hugel in 2017 when the company was dealing with a leadership dispute and controversy over its botulinum toxin strain. Bain Capital injected 454.7 billion won into Hugel through a third-party share allotment and convertible bonds while purchasing a 24.36% stake from Hugel’s largest shareholder, Dongyang HC, for 472.7 billion won securing a total 45% stake for 927.2 billion won.

After the acquisition, Bain Capital appointed Son Ji-hoon, a global pharmaceutical expert who previously led Baxter Korea and Dongwha Pharm, as CEO. It also streamlined Hugel’s operations by merging subsidiaries Hugel Pharma and Hugel Meditech. Bain’s strategic moves included hosting an LPGA golf tournament in the United States and establishing subsidiaries in the U.S. and China as part of an aggressive global market expansion plan.

Bain Capital further strengthened Hugel’s leadership team by hiring Han Seon-ho, a former Baxter Korea and Syngenta Korea executive, as head of sales and marketing, and bringing in James Hartman, a botulinum toxin industry veteran from Allergan and Merz, to lead Hugel America.

In 2020, Hugel became the first South Korean company and the fourth globally to receive botulinum toxin approval in China. To support exports, the company invested 40 billion won to construct a manufacturing facility in Chuncheon, capable of producing 8 million vials annually. Additionally, Hugel expanded its lineup by launching The Chaeum Style, a premium HA filler, securing its position as South Korea’s leading botulinum toxin and filler company.

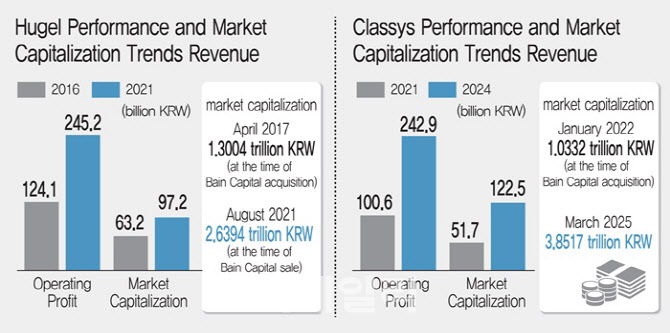

From 2017 to 2021, Hugel’s corporate value soared under Bain Capital’s leadership. The company’s revenue grew from 124.1 billion won in 2016 to 245.2 billion won in 2021, a 97% increase, while operating profit rose 53.7% from 63.2 billion won to 97.2 billion won. Bain Capital successfully sold Hugel to the GS Consortium for 1.72 trillion won in 2021, realizing a profit of 800 billion won in just four years. Hugel’s market capitalization also surged from 1.3 trillion won at the time of Bain’s acquisition in April 2017 to 2.64 trillion won when it was sold in August 2021.

An industry insider said, “Bain Capital developed a long-term growth plan for Hugel’s core businesses botulinum toxin and fillers while recruiting industry specialists and executing aggressive domestic and international marketing strategies, significantly enhancing the company’s value.”

Classys’ Market Cap Soars by 3 Trillion Won After Bain Capital’s Strategic Moves

After exiting Hugel, Bain Capital turned its attention to Classys, a medical aesthetics company, acquiring it for 670 billion won in January 2022. Bain purchased a 60.84% stake and management rights from Classys’ founder, Jung Sung-jae, and his affiliates, who held 73.96% of the company. At the time, Classys had a market capitalization of 1.03 trillion won, with annual revenue of 100.6 billion won and an operating profit of 51.7 billion won in 2021.

Classys specializes in energy-based devices(EBD), which use noninvasive energy stimulation for skin rejuvenation and tightening. The company gained recognition with Shurink, a device used for eyebrow lifting, skin tightening on the face, abdomen and thighs, and wrinkle reduction. Despite entering the market later than its competitor, Merz’s Ulthera, Shurink rapidly gained market share.

At the time of Bain’s acquisition, Classys was preparing to launch a new product to follow Shurink. Bain Capital, after reviewing Classys’ business strategy, proposed a long-term plan for the new product Volnewmer, which debuted in 2022 and became a hit.

Volnewmer delivers radiofrequency thermal energy to the dermis, coagulating tissue for skin tightening. With an advanced cooling system and fast treatment speed, it has quickly gained traction in South Korea, Brazil, Thailand, Japan and Taiwan.

Initially, Classys considered pricing Volnewmer similarly to Shurink, despite higher development and production costs. However, Bain Capital insisted on pricing it according to its innovation value, reflecting its advanced technology and higher research and development expenses.

A Classys official said, “Volnewmer incorporates a completely different and innovative technology from Shurink, requiring more R&D personnel, development costs and testing expenses. Bain Capital emphasized that the price should align with its innovation and development investment.”

With both Shurink and Volnewmer achieving success, Classys became the first South Korean medical aesthetics company to present at the J.P. Morgan Healthcare Conference in 2024, significantly boosting its global recognition. Bain Capital also facilitated the acquisition of Ilooda, a company specializing in aesthetic devices that Classys lacked, and led Volnewmer’s expansion into the U.S. market.

Industry experts believe that Bain Capital’s strategic and proactive approach was instrumental in Classys’ unprecedented growth. This year, Classys aims for 350 billion won in revenue a 100 billion won increase from the previous year while its market capitalization has surged to nearly 4 trillion won. With its strong presence in the global medical aesthetics market, speculation has emerged about potential M&A deals with major global companies.

Currently, Bain Capital executives Kim Dong-wook, Kim Hyun-seung, Choi Yong-min and Park Wan-jin hold nonexecutive director positions at Classys, overseeing management while serving on the board’s nomination and compensation committees. These executives also lead Bain Capital’s M&A activities in the biotech and healthcare sectors.

An industry source said, “Bain Capital has extensive experience in biotech investments in the U.S. and Germany, with deep sector expertise and a strategic approach. In South Korea, every company it has acquired has seen remarkable growth, making Bain Capital-backed firms highly attractive to investors. It will be interesting to see which biotech company Bain Capital invests in next after Classys.”